Loan Application Process

Loan Application

Borrowers are encouraged to securely apply via our app or are most welcome to schedule a face-to-face appointment in our office. Our Loan Officer’s make communication easy whether you prefer email, phone, text or yes, even a fax. Your Loan Officer will customize your mortgage plan to align with our loan products to meet your individual needs. We are there to act as a bridge for communication and insight throughout application all the way to funding. We stay “Committed to the Experience!”

Loan Set Up

- Send required disclosures to client

- Send verification to applicable entities

- Order title and insurance

- Order residential appraisal

Loan Processing

The processor is your contact during all processing and compiling of information for loan submission. Email all information for loan processing to your processor.

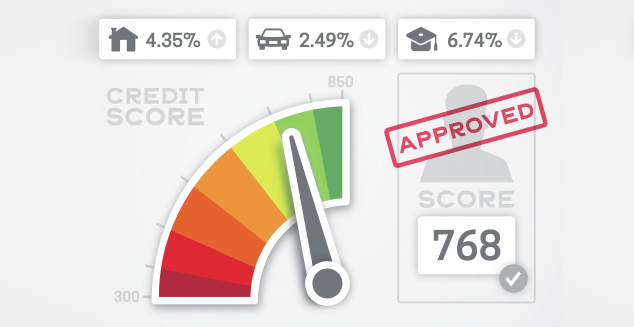

Underwriting

Evaluation of credit and property in determining adherence to Supreme Lending guidelines.

Closing

- Supreme Lending sends prepared docs to the title company.

- Supreme Lending prepares Closing Disclosure, then provides final closing figures.

- Loan Officer will send prepared Closing Disclosure for borrower signature 3 days prior to closing.

Post Closing

Please feel free to call us for any assistance you may need after closing. Thank you for the opportunity to serve your mortgage needs.

Servicing Dedicated Phone: Toll-Free: (866) 219-0032