Understanding Escrow Accounts

It’s not a fun process for anyone, but unfortunately divorce happens – and when there’s a home involved, achieving property title and equity division demands expert analysis and process. Handing over the keys, payment responsibilities and even deeded rights does nothing to absolve one of their obligations to a lender.

If one party is relinquishing their ownership, they should also be released from any liability. Release from financing is a process than can only be achieved by modification, refinance, payoff or sale. In today’s world, break-ups do occur with high frequency and having access to the necessary experience in helping your clients navigate the process as it relates to their mortgage loans is imperative.

One of the common misunderstood aspects of refinancing into a new mortgage is setting up the new escrow account and the costs involved in doing so. This is literally an aspect of mortgage financing where timing is everything.

The amount of funds required to establish a new escrow account is dependent upon the timing of when current and future property taxes and homeowners insurance is due and payable. As you can imagine this can require a significant amount to be added to the new mortgage or require additional cash to close.

Additionally, in divorce situations many clients are not aware of how future reimbursements of existing escrow accounts are handled when paying off or refinancing an existing jointly held mortgage. Any time a jointly held mortgage is paid off, whether through a sale or refinance of the martial home, the current lender will send a joint check made payable to both parties on the existing loan for any refunds on overpayment and escrow balances.

It is very important that we inform our divorcing clients of how overpayments will be handled to avoid any additional future conflict as to which party should receive the funds because both parties will need to endorse the check.

Escrow Accounts: Understanding the How and Why

Many borrowers wonder why they must have an escrow account or why they must put what seems like extra money into it up front. Hopefully I can help answer these questions.

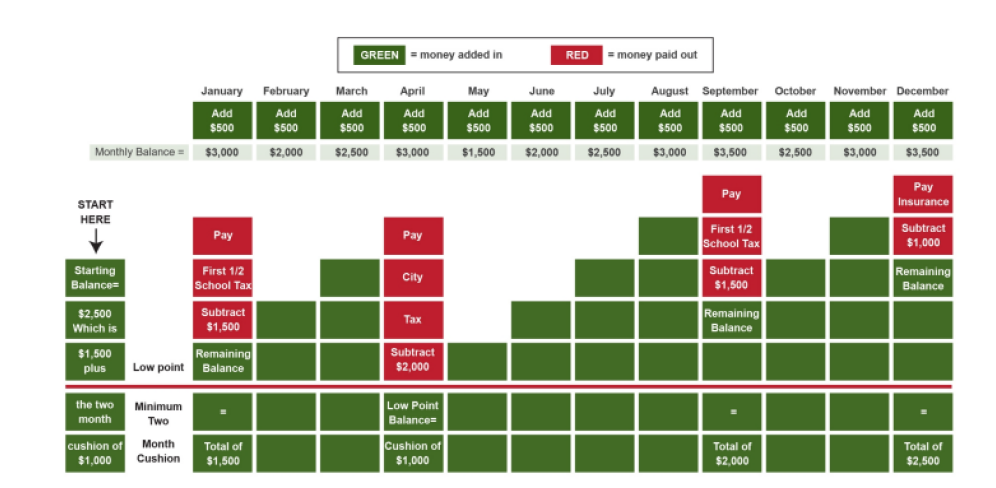

The escrow account will start with a balance calculated to assure sufficient funds are available as each tax or insurance payment is made. This calculation is made by projecting the ‘low point’ which will equal the minimum required reserve and also factors in the regular monthly installments made with each monthly loan payment.

In the illustration below, School and City taxes total $5,000 per year and insurance = $1,000 per year for a total of $6,000. This is paid in equal monthly installments of $500.

Each installment (and block) in this example is $500. Each month, a block/installment is added and the balance builds until an outgoing payment is made.

The minimum required balance will usually be equal to a two month cushion. This is to assure that there are sufficient funds in the account even if two payments were missed or if an outgoing bill is paid prior to the monthly installment being received. In this example, the cushion equals $1,000 (two regular monthly installments at $500 each.)

Why are escrow accounts usually required? A ‘municipal’ or ‘tax’ lien can be the result of unpaid taxes. These can overrule an owner’s or lender’s interest in a property and means that the town can actually ‘take’ the property and sell it at auction for back taxes owed. Insurance is equally important as few people could pay out of pocket to rebuild their home in the event of a disaster.

As most loans are ultimately secured in the Mortgage Backed Securities market, escrow accounts are perceived as adding enhanced safety and in turn, allow for more competitive interest rates.

This is for informational purposes only and not for the purpose of providing legal or tax advice. You should contact an attorney or tax professional to obtain legal and tax advice. Interest rates and fees are estimates provided for informational purposes only, and are subject to market changes. This is not a commitment to lend. Rates change daily – call for current quotations.