Refinancing the Marital Home

Breaking Down the Mortgage Refinance

As an advisor, you have an interest in managing not only the cash flow of your clients assets, but the overall cost associated with these same assets as well. Including your clients mortgages, whether on their primary residence or investment properties.

There are two primary questions when considering a straight rate/term refinance:

1. Is the lower interest rate really worth my while? Many people believe there is a certain ‘point spread’ before it is actually beneficial. Not necessarily the right answer.

2. Is there an actual benefit of going back into a full 30 year or 15 year term when I’m already x number of years into my current mortgage?

- The savings is an arbitrary number which varies in significance with each client. We typically look at the amount of savings and determine the actual time frame in which it takes to recoup the costs of the new mortgage. For example, if it will take 24 months of the new lower payment for the net cash savings to pay off the cost of the new mortgage and the home-owner plans to remain in the home for another 10 years, it is worth the refinance? Also, homeowners refinance for different reasons, mainly cash flow. If the monthly out of pocket cash flow is a positive for the homeowner, then it may very well be worthwhile. Again, it is arbitrary and depends on the individual needs.

- The bigger issue often becomes when a homeowner knows that they could refinance to a significantly lower interest rate, however, they are reluctant to extend the term of their original 30-year (or 15-year) term loan because of the amount of time they already have invested.

Breaking It All Down

Let’s assume a homeowner is considering refinancing his current mortgage which he already has 4 years invested. We are going to compare refinancing to a new 30 year fixed mortgage at a lower rate as well as a new 26-year mortgage thus allowing him to take advantage of current lower interest rates while not adding additional years to his mortgage.

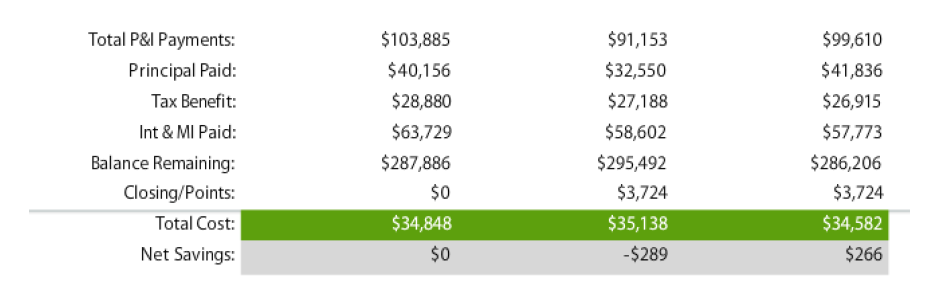

The following chart shows a side by side comparison of the existing loan, a new 30 year fixed and a 26 year fixed. (Assuming closing costs are paid at closing and not rolled into the new loan.) From a cash flow perspective, the new 30 year fixed loan looks to be in the clients’ best interest.

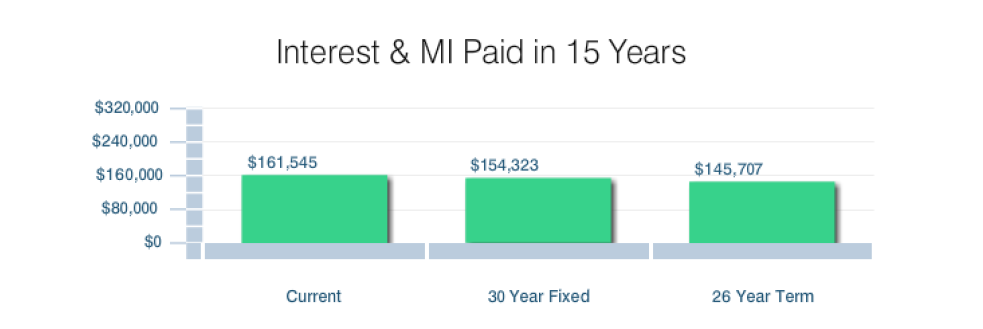

Comparing the total interest paid over a period of 15 years, you can see that taking advantage of the lower interest rates while maintaining the current term of the mortgage results in a savings of $15,838 in total interest paid.

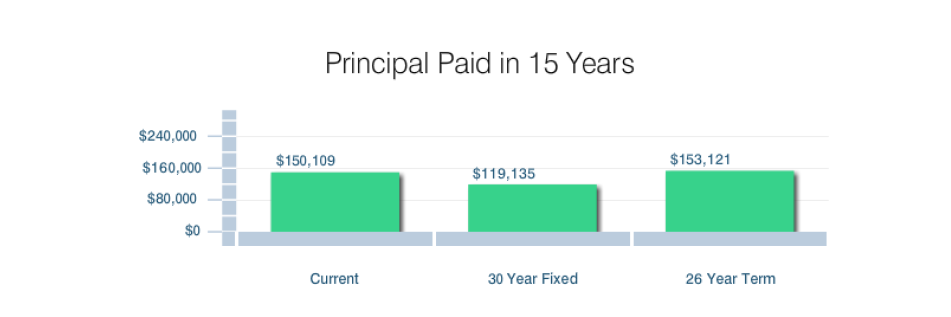

You can further see the advantage of lowering the current interest rate while keeping the current term of the loan as it relates to the larger impact on the amount of principal paid over a 15-year period.

From a cash flow basis, we know that the new 30 year fixed option has a monthly savings of $212.20. However, from a Total Cost Analysis perspective, you can see the overall effect of a new 30-year fixed has a total negative net savings of $289 due to the lost tax benefits and extended term back to the original 30 years.

From a Total Cost Analysis standpoint over 15 years, the new 26 year term loan has an overall positive effect and justification for refinancing. $1,965 more paid towards principal and $5,956 less paid in interest.

Every divorcing clients has their own unique situation which should be analyzed over a Total Cost Analysis to accurately determine the benefit of their various refinance options. If I can provide you or your clients with a TCA of their current mortgage, please don’t hesitate to reach out to me at 469.917.5335 or email me here.

This is for informational purposes only and not for the purpose of providing legal or tax advice. You should contact an attorney or tax professional to obtain legal and tax advice. Interest rates and fees are estimates provided for informational purposes only, and are subject to market changes. This is not a commitment to lend. Rates change daily – call for current quotations.